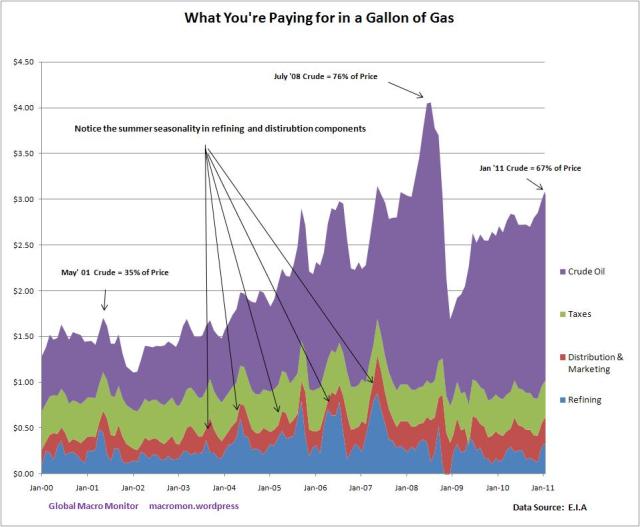

Traveling in California today we witnessed $4.00 gas and prompted us to think what makes up the price. We constructed the following chart from a U.S. Energy Information Agency (E.I.A.) time series.

Notice in May 2001 the crude component of a $1.71 gallon of gas was 35 percent of the price versus 76 percent during the Summer ’08 price spike. Also interesting is the 8 cent loss per gallon for refiners in November ’08 as they were caught holding expensive crude inventories as retail gasoline prices fell 60 percent from July to December.

What a potential toxic inflation brew: $4.00 gas price, zero percent interest rates, QE2, and an accelerating global economy. Bonds anyone? China better slow quickly.

The components for the gasoline are calculated in the following manner in cents per gallon:

Crude Oil – the monthly average of the composite refiner acquisition cost, which is the average price of crude oil purchased by refiners.

Refining Costs & Profits – the difference between the monthly average of the spot price of gasoline (used as a proxy for the value of gasoline as it exits the refinery) and the average price of crude oil purchased by refiners (the crude oil component).

Distribution & Marketing Costs & Profits – the difference between the average retail price of gasoline as computed from EIA’s weekly survey and the sum of the other 3 components.

Taxes – a monthly national average of federal and state taxes applied to gasoline.

(click here if chart is not observable)

Pingback: Chart of the Day: Components of the Gasoline Price | The Big Picture

Pingback: Weekend Reads « Managed Futures Blog

Pingback: Chart of the Day: Components of the price of Gasoline « The Road More or Less Travelled

Pingback: Chart of the Day: Components of the Gasoline Price | Jackpot Investor

no help

Pingback: O preço da gasolina e seus mistérios | Blog do Dr. Money

Something that this fails to show is how much of this price come from taxes other than “gas tax.” Every component of this process has its own taxes added into the cost of doing business, so the true picture of how much of the gas price is due to taxes is much higher.

I must express appreciation to the writer just for bailing me out of such a incident. Because of looking out throughout the search engines and finding recommendations which were not helpful, I thought my entire life was done. Being alive without the answers to the difficulties you have solved by way of your website is a critical case, and ones which may have in a negative way damaged my career if I hadn’t come across your web site. Your primary skills and kindness in touching a lot of things was priceless. I don’t know what I would have done if I had not encountered such a point like this. I am able to at this moment look ahead to my future. Thanks for your time so much for the reliable and effective guide. I will not hesitate to refer the blog to any person who requires guide about this issue.