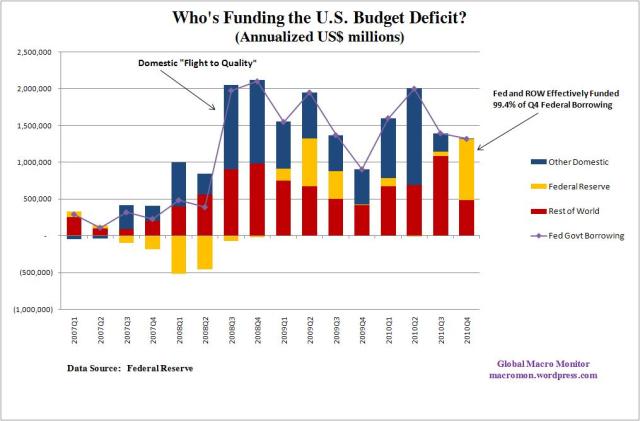

A couple of revealing charts from the Fed’s Flow of Funds data. Both show net flows into Treasuries by creditor type and the Federal Government’s borrowing during each quarter. Note, the quarterly data is annualized.

The first chart illustrates how QE2 flushed domestics out of Treasuries and effectively funded 63 percent of the budget deficit in Q4. The Treasury is prohibited from directly selling bonds to the central bank, but effectively finances the government through POMO.

Given that a large portion of the Rest of World category are central banks recycling BOP surpluses, it’s likely that 90 percent of the U.S. budget deficit in Q4 was funded by central banks. You think this may have anything to do with what’s happening in the commodity markets? That is, the central banks’ printing presses providing the fuel for speculators?

Furthermore, we ask: who is going to finance the U.S. budget deficit when QE2 ends, especially at a sub 3.50 percent 10-year Treasury rate? Bill Gross knows!

(click here if charts are not observable)

(click here if charts are not observable)

Pingback: Is This Why Bill Gross Dumped Treasuries? | The Big Picture

Your best post so far. Congrats.

Thanks, JL…

NOw juxtapose the spooz overlay pomo with flow funds , theres you answer.

I don’t see how this isn’t a bond bubble.

And discounting inflation due to Phillips Curve assumptions shortchanges potential EuroDollar flows. It’s not a matter of if…but when.

Pingback: FT Alphaville » Further further reading

Hey author,

Is it possible the domestics aren’t showing up on Q4 because they can quickly flip the treasuries over to the Fed? Basically, they would otherwise hold on to the treasuries if there wasn’t the possibility of a quick POMO profit.

What I’m thinking is that in the absence of a Fed buyer, its possible that the domestics may yet purchase and hold treasuries. This scenario may not necessarily involve rates that are dramatically higher.

Good points, Richard. Note these are net flows, so there were domestic buyers of Treasuries in Q4, but the sales of broker/dealers offset, say, the household and corporate business purchases. Clearly, when the Fed steps aside, domestics and foreigners will have to step up, but it will probably be at a much more attractive purchase price/higher interest rate.

Pingback: Monty Pelerin's World » QE ing Our Way to Oblivion

Pingback: Week in Review: Anti-Nukes Nuke Merkel | Global Macro Monitor

Pingback: Monetizing the Debt | Things that were not immediately obvious to me

Pingback: The Great QE2 Flush Out | Global Macro Monitor

Pingback: The Great QE2 Flush Out | The Big Picture

Pingback: Is This Why Bill Gross Dumped Treasuries? | Jackpot Investor