Here’s some interesting data the Fed is surely looking at.

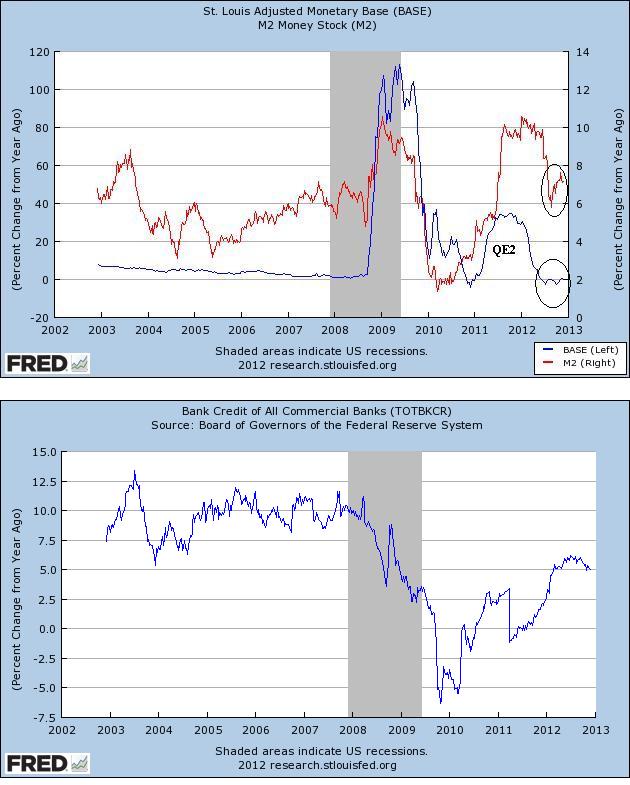

The monetary base has been flat lining since the end of QE2 — i.e., the balance sheet growth of the Federal Reserve has not been above long-term growth. May explain the punk performance of gold.

The monetary aggregates, as reflected in M2 growth, though healthy, has slowed somewhat. Bank credit is growing at about 5 percent y/y, which reflects a slow healing of the financial sector, but still not at 100 percent health.

Furthermore, the shadow banking system is a still a shadow of its former itself with respect to credit expansion. Thus, relatively flat base growth and slowing M2 (though less relevant) makes us think the Fed will remain aggressive. Stay tuned.

(click here if charts are not observable)

(click here if charts are not observable)

There’s an interesting non-correlation between the base and M2 during the oughts. Since the GFC, any correlation is, IMHO, spurious. Ditto for bank loans and M2 in the earlier period. Perhaps there is some correlation during the recovery. So, have the various QE’s really made much of a difference to the recovery?

Stewart, Thanks for comments. Don’t forget the leads and lags of monetary policy that Friedman spoke about. Also, the rise of the shadow financial system and its demise affects monetary policy. At the end of the day, monetary policy is a black box. Even Bernanke cannot even define what is money and has no idea how policy affects the economy.