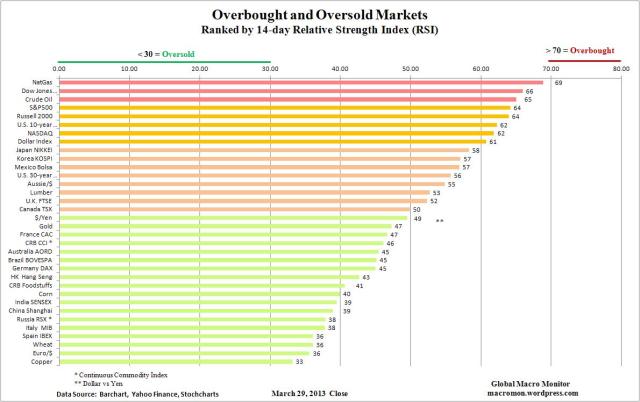

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price moves. The RSI moves between zero and 100 and is considered overbought with a reading above 70 and oversold when below 30. Note the RSI can sustain an overbought (oversold) reading in a strong up (down) trend.

Click chart to enlarge.

(click here if chart is not observable)

Pingback: Sunday links: misery loves company - Abnormal Returns | Abnormal Returns

Pingback: Overbought and Oversold / Global Trend Indicators | The Big Picture

Pingback: Overbought and Oversold / Global Trend Indicators - Euro News Cloud

Pingback: Monday reads & daily charts … « Fusion Blog