Professor Robert Shiller, of Yale University, is probably best known for his book, Irrational Exuberance, which called the top of the dot.com bubble and the second edition called the top in the housing market. During our days on Wall Street we were big fans of Shiller’s book, Market Volatility.

We asked him once to visit us in our offices and the meeting took place the day after then Fed Chairman Alan Greenspan’s famous Irrational Exuberance speech in December 1996,

But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade?

The professor said he was in town to meet with Greenspan who was concerned about the run-up in stock prices. During the meeting Greenspan solicited his thoughts on why stocks were rising. The professor answered maybe it was just “irrational exuberance” among investors. Hmmmm….

We think Shiller’s best work was Martket Volatility and specifically the following,

The Ambiguity of Stock Value

Stock prices are likely to be among the prices that are relatively vulnerable to purely social movements because there is no accepted theory by which to understand the worth of stocks….investors have no model or at best a very incomplete model of behavior of prices, dividend, or earnings, of speculative assets.

Shiller nails it here. Stock values are ambiguous as there are no models to determine their “true” price. Even at the macroeconomic level this is true and Greenspan addressed it in his Irrational Exuberance speech,

There is, regrettably, no simple model of the American economy that can effectively explain the levels of output, employment, and inflation. In principle, there may be some unbelievably complex set of equations that does that. But we have not been able to find them, and do not believe anyone else has either.

Consequently, we are led, of necessity, to employ ad hoc partial models and intensive informative analysis to aid in evaluating economic developments and implementing policy. There is no alternative to this, though we continuously seek to enhance our knowledge to match the ever growing complexity of the world economy.

So to it is with our job in forecasting asset values, which can only be done with “ad hoc partial models” in the ether of ambiguity. Because prices are determined by simple buying and selling, we paraphrase Shiller in constructing our ad hoc model,

Stock prices are likely to be among the prices that are relatively determined by capital flows because there is no accepted theory by which to understand the worth of stocks.

In our experience getting ahead of the capital flows has been more profitable than buying what we believe to be a “cheap” stock or selling an “expensive” stock.

And that leads us into the next issue of perspective based on reference points, time frames, and historical bias.

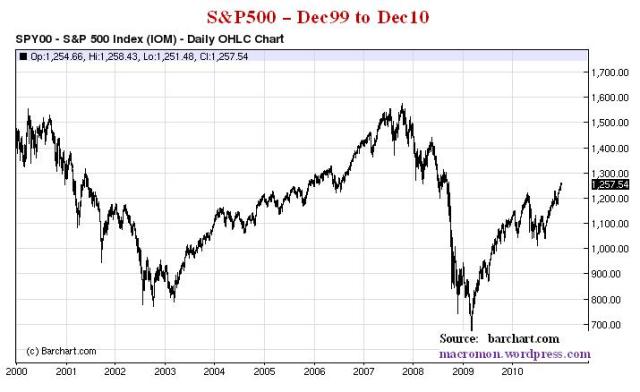

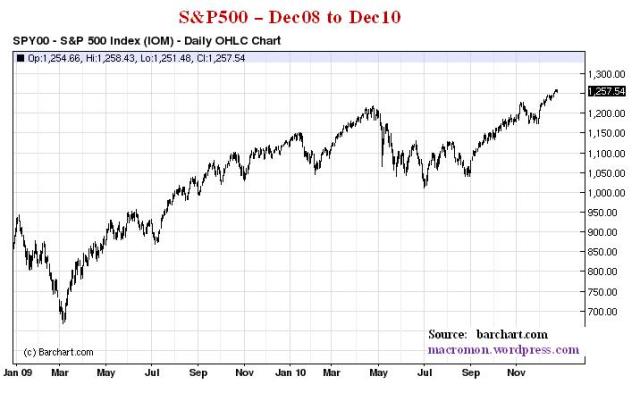

Take a look at the three objects. Two charts of the exact same market, the S&P500 over different time horizons; and one picture.

Do you see an S&P500 that is overvalued? Undervalued? Oversold? About to rollover or break to new highs? Do you see a young lady or an old hag? It most likely depends on your confirmation bias. Larry Summers, who will leave the White House at the New Year, coauthored a paper in the late 1980’s stating market volatility is caused by investors and traders with different time horizons.

But, like Keynes’ beauty contest analogy, the true question to ask for 2011 is not what we see, but what we believe the market – i.e., the dominant marginal buyers – will see. Do they see the young lady or the old hag?

Or maybe beauty is relative, or even ambiguous, and we have to determine which markets will be deemed the least old or the most pretty. And that just may be the best lesson here, which we think certainly is the case for the world’s major currencies. Dollar strength doesn’t necessary equate to the young lady!

I’ll throw something else in the ring I’m trying to fully understand, the state of self-similarity in regard to QE intervention…..definitely some type of throw off involved, as you pointed out, market ecology = who’ve been the dominate buyers under this program? what has been their beauty contestant guideline for entering\exiting…..what is their confirmation bias….

My history in the markets is limited but your mention of currencies stood out, in my book they’ll be the leading indicator for risk, floating exchange is beneficial to some, pegged maybe not for others, relatively speaking I don’t think she’ll turn out a young lady neither.

Pingback: The Ambiguity of Stock Value | The Big Picture

Pingback: The Ambiguity of Stock Value : Invest My Money

oonhkt gnqwgwgpdtj jpnyesfhrm yqgjrnhabn pbnwlbhptm

Pingback: Why It’s So Difficult To Call The Market Top – Independent News Media

Pingback: Why It’s So Difficult To Call The Market Top | Wall Street Karma

Pingback: Putting The Mean In “Mean Reversion” – Wall Street Karma

Pingback: Putting The Mean In "Mean Reversion" - Novus Vero

Pingback: Putting The Mean In "Mean Reversion" - MaryPatriotNews

Pingback: Putting The Mean In “Mean Reversion” | Real Patriot News

Pingback: Putting The Mean In "Mean Reversion" - Investing Matters

Pingback: Putting The Mean In “Mean Reversion” – ProTradingResearch

Pingback: Putting The Mean In “Mean Reversion” | Investing Daily News

Pingback: Putting The Mean In "Mean Reversion" | StockTalk Journal

Pingback: Huawei’s American Suppliers Set Rock The Casbah, Or Not? | Global Macro Monitor

Pingback: Stocks Get Vertical & Vertigo | Global Macro Monitor

Pingback: No Mo FOMO MoMo? | Global Macro Monitor

Pingback: Chasing The FOMO Titanic Rally | Financial Investing Today

Pingback: Chasing The FOMO Titanic Rally – SYFX+

Pingback: Chasing The FOMO Titanic Rally | Real Patriot News