The yield curve is flattening like a pancake. Tightening cycles tend to do that.

Furthermore, the effective float of 10-year and longer U.S. notes and bonds is relatively small and greatly distorts the bond market signal. We have written about this several times.

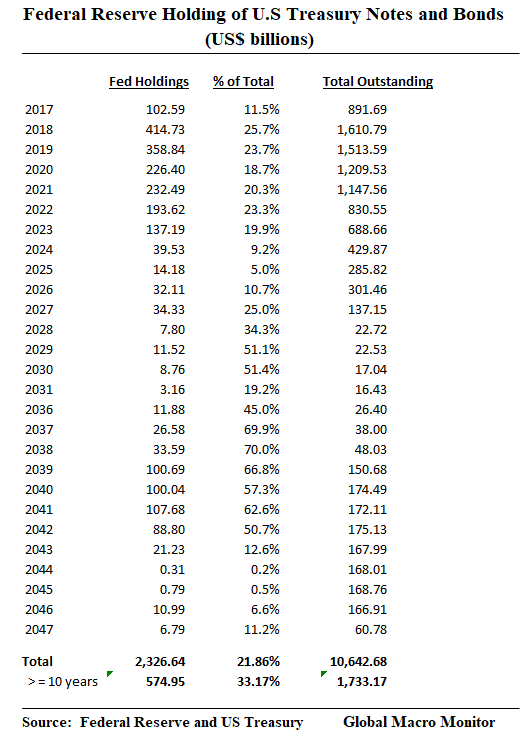

…how small the actual float of longer-term marketable U.S. Treasury securities is available to traders and investors. The data show the Fed owns about 35 percent of Treasury securities with maturities 10-years or longer. Note the data only include notes and bonds and excludes T-Bills.

The Fed’s holdings combined with foreign ownership of longer maturities — more than 1-year — exceeds 80 percent of marketable Treasuries outstanding. The Fed combined with just foreign official holdings, mainly, foreign central banks, is 65 percent of maturities longer than 1-year. Thus, almost 2/3rds of tradeable Treasuries longer than 1-year are held by entities with no sensitivity to market forces. – GMM, March 2017

Given the small float of tradeable Treasury notes and bonds, the market is subject to both massive short squeezes if it gets too far offside and rapid ramps if traders algos try and game duration.

Information Positive Feedback Loop

Many in the market, we fear, are being hoodwinked by the flattening yield curve, however. It’s purely the result of technicals and not economic fundamentals.

Nevertheless, some still look to the badly distorted bond market as a signal of the health of the economy and act accordingly. Such as delaying capital spending; becoming more risk averse; and cutting back on consumption, for example.

A flatter yeld curve also makes bank lending less profitable.

This could thus lead to what George Soros calls “reflexivity“, a feedback loop where the negative, but false, signal from the bond market actually causes an economic slowdown or leads to a recession. So much for efficient markets.

Recall the famous line of one prominent market strategist during the dark days of the great recession,

“ We’re in a depression. That is what the bond market is telling us.”

Or the ubiquitous, “what is the bond market telling us?” Come on, man!

The Fed Needs To Start Selling Longer Dated Securities

It would, therefore, behoove the Fed to sell some of its longer dated Treasury holdings in order to steepen the yield curve.

The following table shows the Federal Reserve’s holdings of U.S. Treasury securites and the total Treasury outstandings for each year. This table does not include T-Bills.

If the Fed were to just let its balance sheet “run off” — that is not rollover maturing notes and bonds — it would cause additional pressure on short-term interest rates even as policy rates are rising. It could also potentially invert or further distort the front-end of the yield curve and destablize the money markets.

Looking at the data in 2018 and 2019 large maturities are coming due, of which, the Fed holds about 25 percent of the total of Treasuries maturing.

Rolling a portion of these maturities and selling longer-dated securities would probably cause less disruption in the market and be a more optimal strategy of reducing the Fed balance sheet.

Announcement Effect

Just announcing the fact the Fed was contemplating such a strategy of unloading longer dated Treasuries first would cause the yield curve to steepen. The market would begin to front run the Fed. Bill Gross & Co. would kick into action and start “selling what the Fed wants to sell.”

And because there are so relatively few Treasuries outstanding with maturities longer than 10-years, it is unlikely it would cause the bond market debacle, which many believe is coming. The total stock of Treasury securities with maturities longer than 10-years is smaller than the combined market capitalization of just Apple, Google, and Amazon, for example.

If bonds become too oversold, the Fed could easily engineer a short squeeze to bring the yield curve back to where it desires.

Recall, the Fed losing control of the yield curve prior to the financial crisis to foreign central banks recyling capital flows back into the U.S. bond market is what Alan Greenspan singles out as the major cause of the housing bubble. The Fed moved the funds rate up 425 bps and the 10-year and mortgage rates barely budged.

During the 2004-07 tightening cycle, the era of the Greenspan bond market conundrum, for example, the 10-year yield managed to rise only a maximum of 64 bps during the entire cycle from a beginning yield of 4.62 percent to a cycle high yield of 5.26 percent. This as Greenspan raised the fed funds rate by 4.25 percent, from 1.0 percent to 5.25 percent. – GMM, March 2017

Risks

The major risk is that foreigners begin to sell. But where will they go?

Spanish 10-years at 1.43 percent? German 10-year bunds at 0.266 percent? How about a 10-year Japanese JGB at 0.067 percent? In fact, low foreign yields and the ensuing portfolio effect is keeping the U.S. 10-year note well anchored below 2.60 percent and another factor distorting the yield curve.

Central banks could also be forced to sell some of their $4 trillion U.S. Treasury holdings if global currencies come under pressure via-a-vis the dollar. To maintain currency stability, monetary authorities could be forced to intervene in their foreign exchange markets.

Such was the case with China over the past few years, which experienced a major bout of capital flight. The PBOC suffered a loss of FX reserves close to a trillion dollars, some of which were held in U.S Treasuries.

Credit and Equity Markets

That is where we could have some short-term problems and overshooting. But our sense, many are waiting to pounce on a sell-off in the spread and equity markets. Too many pensions are underfunded and too many seniors are yield strarved.

Having some dry powder makes sense. It’s coming and you will have to act fast.

Conclusion

A sustained spike in inflation?

Tilt! Game over, comrades.

Pingback: Reflexivity And Why The Fed Must Sell The Long End – Earths Final Countdown

Pingback: Reflexivity And Why The Fed Must Sell The Long End | It's Not The Tea Party

Pingback: Reflexivity And Why The Fed Must Sell The Long End

Pingback: Reflexivity And Why The Fed Must Sell The Long End | CapitalistHQ

Pingback: Reflexivity And Why The Fed Must Sell The Long End - BuzzFAQs

Pingback: Reflexivity And Why The Fed Must Sell The Long End | Juan Darden's Blog

Pingback: Reflexivity And Why The Fed Must Sell The Long End | StockTalk Journal

Pingback: Reflexivity And Why The Fed Must Sell The Long End | Melinda Owens's Blog

Pingback: Reflexivity And Why The Fed Must Sell The Long End | Linda Frazier's Blog

Pingback: Reflexivity And Why The Fed Must Sell The Long End – Independent News Media

Pingback: Reflexivity And Why The Fed Must Sell The Long End | Zero Hedge

Pingback: Reflexivity And Why The Fed Must Sell The Long End | Economic Crisis Report

a

This probably the most misinformed analysis of the Treasury market and the flat yield curve dilemma I have read in a public forum

Data, data, data, my friend!

Pingback: Reflexivity And Why The Fed Must Sell The Long End - We Go Blog | Buzz

Pingback: 06/15/17 – Thursday’s Interest-ing Reads | Compound Interest-ing!

b.

I find the analysis very interesting.

The problem with managing the yield curve in this manner, though, is that it will bring on just another boatload of unintended consequences.

We’ve started down the path of managing interest rates and the consequences have been jacked up asset prices and economic growth over the last ten years that exactly matches the 1930’s great depression-1.33%. Yes. Believe it or not, the last ten years avg gdp growth rate was 1.33%.

Not one iota different from the great depression.

Doubling down on gov’t interference is VERY unlikely to fix round accomplished. It will almost certainly only make it worse.

Thanks for great comments, Mike.

Pingback: The Incredible Shrinking Relative Float Of Treasury Bonds | ValuBit News

Pingback: The Incredible Shrinking Relative Float Of Treasury Bonds | StockTalk Journal

Pingback: The Incredible Shrinking Relative Float Of Treasury Bonds – Independent News Media

Pingback: Gold Bounces at Long-term Support. Weekend Update June 23, 2017 | ThePracticalInvestor.com

Pingback: More surprises from the Fed? | Humble Student of the Markets

Pingback: When “Whatever It Takes” Ends | NewZSentinel

Pingback: When “Whatever It Takes” Ends – Independent News Media

Pingback: When “Whatever It Takes” Ends | It's Not The Tea Party

Pingback: The New "Supply-Side Economics" Fueling Asset Bubbles | ValuBit News

Pingback: The New "Supply-Side Economics" Fueling Asset Bubbles | NewZSentinel

Pingback: The New “Supply-Side Economics” Fueling Asset Bubbles | US-China News