We have been warning over the past few weeks that the macro swans have been gathering. See here, here, and here.

Swan Watch

The Global Macro Monitor defines “macro swan” as any global macroeconomic or financial event with the capacity to spill over into world markets causing risk aversion and lower asset prices. Today, they attacked.

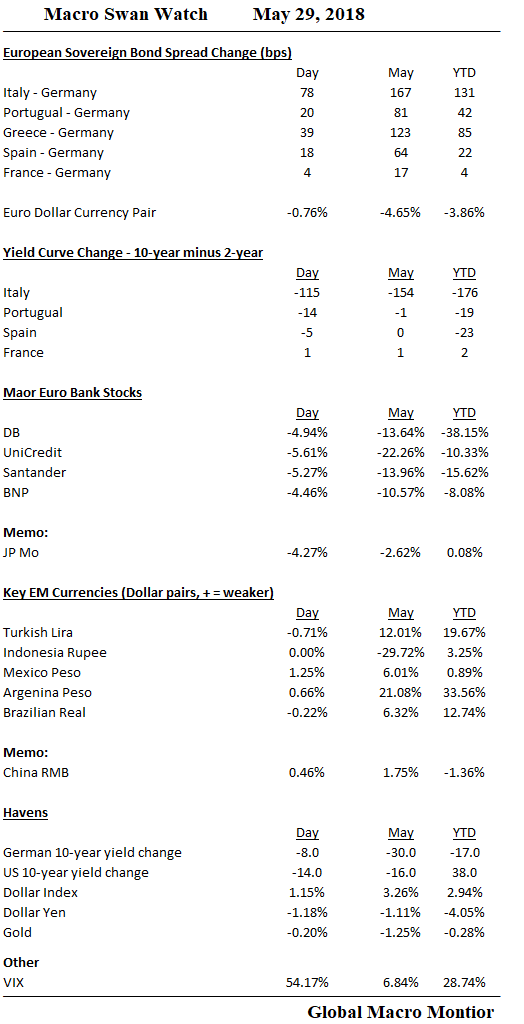

We don’t know how long this is going to last but it will almost certainly last longer than the cheerleaders suggest. We will continue to monitor the market signals and will try and post a our swan watch table (see below) on a daily basis until the coast is clear. It is a work in progress and will change over time.

Euro and EM Swans

The big swans we are currently focusing on are the Italian-led bond market crash in the Euro periphery and the exchange rate and bond volatility in a few of the large emerging markets.

While gathering the data what stands out the most is the massive and rapid curve flattening in Italy relative to the other periphery countries. Curve inversion is signal of potential credit problems and worries of default. Not seeing that in the other periphery countries yet.

Deutsche Bank

Deutsche Bank, another macro swan, was hammered today with the stock closing in the single digits at €9.82. The bank’s market cap of €20.3 billion now supports a €1.48 trillion balance sheet. That’s a market cap to asset ratio of 1.38 percent. Something may be rotten in the state of Denmark Deutsche’s balance sheet.

Conversely, JP Morgan’s market cap of $360.6 billion supports a balance sheet of $2.61 trillion, a market cap to asset ratio of 13.8 percent. That is a healthy bank.

Keep it on the radar.

The Fed

Finally, lots of chatter today how the Fed will have to slow its interest rate hikes. Maybe, maybe not.

More important is what are they are going to do with their balance sheet?

That part of monetary tightening is on autopilot and won’t be adjusted unless the FOMC takes extraordinary action. We calculate SOMA account holdings on the balance sheet have been reduced by $107 billion since September 2017, including a $87 billion decline in Treasury notes and bonds and $24 billion in agencies.

Also, another $300 billion of balance sheet reduction is on the books from June to December, including a roll off of $180 billion in Treasury notes and bonds and $120 billion in agencies. Nobody knows the consequences of how such a sharp reduction in the monetary base will affect markets, but we may be seeing it in how some of the indicator species of tighter money, such as the emerging markets, are currently behaving.

Stay tuned.

I think the term “macro swan” would prefer to macro risks that you believe are massively under-estimated, correct?

On Tue, May 29, 2018 at 10:03 PM, Global Macro Monitor wrote:

> macromon posted: “We have been warning over the past few weeks that the > macro swans have been gathering. See here, here, and here. Swan Watch The > Global Macro Monitor defines “macro swan” as any global macroeconomic or > financial event with the capacity to spill over int” >

Pingback: The Tell: Falling Deutsche Bank shares reignite ‘black swan’ worries | Market Tamer

Pingback: The Financial Post - Just another WordPress site

Pingback: Falling Deutsche Bank shares reignite ‘black swan’ worries | One World Media

Pingback: Falling Deutsche Bank shares reignite 'black swan' worries | Investing and Trading News

Pingback: The Tell: Falling Deutsche Bank shares reignite ‘black swan’ worries – Retirement Cheat Sheet

Pingback: Falling Deutsche Bank shares reignite ‘black swan’ worries – Finance Magazine