We woke to a comment out of Davos that surprised both us and the market.

The U.S. Treasury Secretary, Steven Mnuchin, broke from tradition and welcomed a weaker dollar.

“Obviously a weaker dollar is good for us as it relates to trade and opportunities,” Mnuchin told reporters in Davos. Mnuchin said recent declines in the value of the dollar against other currencies were “not a concern of ours at all.” – Steven Mnuchin

We question the Secretary’s wisdom and timing of such an announcement. The White House tried to walk some of it back, but, it appeared, only half-heartedly.

Foreigners Are America’s Largest Creditor

First, foreigners own more than 50 percent of marketable Treasury securities and now finance most of the U.S. budget deficit. It comes at a time when the Fed, who has monetized almost all the U.S. budget deficits since the great financial crisis (GFC), has stopped QE and has even begun to run off their Treasury holdings.

All other things being equal (which they are not), interest rates will have to rise to compensate foreign holders of U.S. bonds for the weaker currency.

How do you think the People’s Bank of China (PBOC) and Bank of Japan (BoJ) are feeling today with their country’s $2 trillion-plus holdings of Treasury securities?

Pissed off, we suspect.

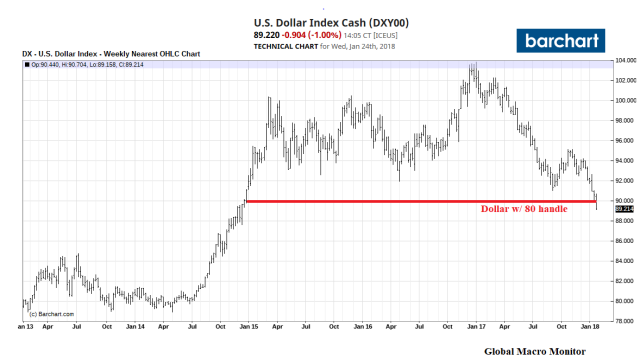

We have voiced our concern as we have noticed over the past few weeks the dollar weakening as interest rates are rising. A red flag.

Bad Timing

Second, is the timing.

The U.S. economy is humming at full capacity with inflation already on the cusp of moving higher. A weaker dollar is, effectively, a monetary easing and makes the Fed’s job that much harder at a time when financial conditions are incredibly loose.

.

.

The Administration also just announced the implementation of tariffs on solar panels and washing machines. LG Electronics has already announced they plan to raise prices on some of its models. Retaliation by our trading partners seems likely. Ergo inflationary pressures increase on the margin.

Tax Repatriation To Strengthen The Dollar?

Finally, we hear from market pundits the dollar is going to strengthen because, say, Apple, is about to repatriate all its foreign holdings of $200 billion-plus cash back to the United States.

Doesn’t Apple already hold almost, if not, all of its cash in dollar-denominated securities? The only difference is that most is domiciled in Ireland. Thus no need for currency conversion, right? Just askin’.

We suspect that the same holds for most U.S. multinationals. Please correct us if we are wrong.

Geopolitics and the global political economy are about to get even more interesting.

Amateur hour in Davos.

Excellent post. With the tariff wars ramping up, China’s next major export could be U.S. Treasuries. Dalio called out the biggest bond bear in 40 years today. Yikes !

Thanks, KD.

Apples dollars from Ireland are sitting in NY’s branch of Irish-Allied Bank in the form of Treasuries and corporate bonds.

https://www.americanprogress.org/issues/economy/reports/2014/01/09/81681/offshore-corporate-profits-the-only-thing-trapped-is-tax-revenue/

Thanks for that, FDR.

Pingback: Watch This Space | Investing Daily News

Pingback: Watch This Space | peoples trust toronto

Pingback: Watch This Space – ProTradingResearch

Pingback: Watch This Space – Wall Street Karma

Pingback: Watch This Space – eforexblog.com

Pingback: Watch This Space | Economic Crisis Report

Pingback: Watch This Space | Easylinkspace.com

Pingback: Watch This Space | verylost.me

Pingback: Is Trump Starting To Lean On The Fed Or Setting It Up? | peoples trust toronto

Pingback: Is Trump Starting To Lean On The Fed Or Setting It Up? | Real Patriot News