Summary

- Our analysis provides kind of a Grand Unified Theory (GUT) of what is currently taking place in global financial markets

- The massive borrowing by the U.S. Treasury is crowding out emerging markets capital flows

- The structural factors that have kept long-term interest rates low and term premia repressed are fading

- We expect a measured move in the 10-year Treasury yield to 4.25 to 4.40 percent, much sooner than the market anticipates

“Reagan proved deficits don’t matter.” – Dick Cheney

Memo to Dick Cheney:

- Deficits and the public debt are starting to matter. Really.

- It is now more strikingly true than ever given the U.S. public debt-to-GDP is more than 3.4x higher than when President Reagan took office.

Emerging Market Debacle

Go no further than the debacle currently taking place in the emerging markets (EM), which began in the second quarter of this year, to witness the consequences of the U.S. Treasury’s trillion-dollar-plus demand shock for global funding.

In a closed financial system and a non-QE world, price (interest rates) would adjust to move the capital and debt markets back to a more sustainable equilibrium. The rise in interest rates would force the government to borrow less as higher interest rates crowd out other spending. Also, the supply of loanable funds to the government would rise as savings increase.

That is not the world we now inhabit, however, where global financial repression by central banks has resulted in a “rent control” like shortage of dollar funding. The shortfall is now being plugged, in part, by the residual capital flows, which had been chasing yield in the emerging markets over the past several years.

That is the sucking sound you have heard since late April.

Crowding Out Begins

Therefore, it is no surprise, at least to us, global markets, beginning with the most vulnerable twin deficit EMs, are experiencing significant pressure from the crowding out caused by the U.S. Treasury’s massive increase in market borrowing.

U.S. Government Hoovering Up Global Funding

The following table illustrates the Treasury borrowed close to $1 trillion from the public in the first eight months of 2018, more than a trillion dollar swing from the same period last year.

Almost 85 percent of the 2018 new debt issuance was in the form of marketable securities, that is borrowing from the public markets, of which more than half was T-Bill issuance, explaining the pressure on short-end of the curve and a growing scarcity of dollars.

Debt Ceiling And Treasury Borrowing In 2017

Because of the constraints on raising the debt ceiling in 2017, total net Treasury issuance to the public from January and August 2017 was a net negative. Marketable note and bond issuance did increase around $200 billion, however, probably over worries about disrupting the market and liquidity concerns.

The government was financed in January to September 2017, primarily by the Treasury reducing its cash balances at the Fed and “other means of financing,” such as deferring payments to federal retirement accounts, and a game of three-card monte by shifting funds around.

Means of Financing

Ways in which a budget deficit is financed or a budget surplus is used. A budget deficit may be financed by the Department of the Treasury (Treasury) (or agency) borrowing, by reducing Treasury cash balances, by the sale of gold, by seigniorage, by net cash flows resulting from transactions in credit financing accounts, by allowing certain unpaid liabilities to increase, or by other similar transactions. It is customary to separate total means of financing into “change in debt held by the public” (the government’s debt, which is the primary means of financing) and “other means of financing” (seigniorage, change in cash balances, transactions of credit financing accounts, etc.). – GAO

The spike in new debt issuance in 2018 is not only caused by the financing of a larger budget deficit due to the tax cuts and big ramp in spending, but also the rebuilding and maintaining of the Treasury’s cash balance at the Fed , and the likely reduction in obligations incurred through “other means of financing” in 2017.

Quantitative Tightening (QT) And Roll-Off Of Maturing Treasuries

Furthermore, the Fed began quantitative tightening last October, starting its roll-off of the $4 trillion-plus maturing securities (SOMA) purchased during quantitative easing.

Thus far, the Fed’s SOMA portfolio consisting of both Treasury and Agency Mortgage-Backed securities has declined by around $231 billion, which is not insignificant, and equivalent to 6 percent of the U.S. monetary base.

The Fed’s roll-off of $145 billion in Treasury securities in the first eight months of 2018 is a hole that had to be plugged by the market, otherwise the Treasury’s cash balances held at the Fed would have declined. The Treasury cash reduction at the Fed is the liability side of the Fed’s shrinking balance sheet , which was not the case during QE where asset purchases created a corresponding liability in the form an increase in bank reserves held at the Fed.

“Global Liquidity”

Global liquidity, in the form of base money is shrinking, but the monetary aggregates continue to grow, albeit slowly, which reflects credit is still expanding, and the continued creation of endogenous money.

The term “global liquidity” is not easily defined, it is an elusive and ambiguous concept, and almost impossible to measure. We believe our analysis and work provides a much clearer framework and more concise picture of the current global market dynamics.

Emerging Markets – The Indicator Species Of Changing Financial Ecosystem

Nevertheless, we are always looking for indicator species of a changing global monetary ecosystem, and the emerging markets and commodities are the best we have discovered.

“Sleeping With An Elephant”

Justin‘s father, the former Canadian Prime Minister and, more important, husband of Margaret Trudeau, once said of living in a world with the United States,

Living next to you is in some ways is like sleeping with an elephant. No matter how friendly and even-tempered is the beast if I can call it that, one is affected by every twitch and grunt. — Pierre Trudeau.

Due to the relatively large size of the U.S. economy, just a small change in its funding requirements have outsize effects on the global financial system. The table below illustrates this point. It’s obese proportion relative to the global economy also makes the U.S. government a price maker in the global financial markets.

The issuance of marketable Treasury securities and the SOMA Treasury roll-off totaled $1.02 trillion in the first eight months of 2018. That is almost four times the sum of the ten largest 2018 estimated current account deficits in the emerging markets; 2.4 times the combined current account deficits of all emerging markets; 3.7 percent of the emerging market 2018 GDP, and almost 5 percent of the GDP of all emerging markets x/ China. Yuuge!

We cannot impress enough what a significant shock to the financial markets this has been in 2018. The Treasury net take-out from the public was net-zero from January to August 2017. Compare this to the first eight months of 2018, in which the U.S. G hoovered up over a trillion dollars from the markets.

In the world of full-blown quantitative easing, where central banks were printing reserves to purchase government bonds (among other assets) the effects were trivial, null, nonexistent.

What about now, you ask? The times they are a-changin’.

Source: Zero Hedge

Countries caught running large deficits are now having their Wile E. Coyote moment.

Why Haven’t U.S. Long-Term Interest Rates Spiked?

Good question.

Real long-term interest rates continue to hover around zero percent, which seems absurd to us, given nominal GDP growth is running at over 6 percent.

Prior to the Great Financial Crisis (GFC) the effective real interest rate on the 10-year Treasury note, measured with CPI inflation, average 2.71 percent from 1962-2008 compared to 0.85 percent during the last ten years, 2008-2018. We estimate the real rate at 0.16 percent at the end of August.

The Bond Vigilante Model suggests that the 10-year Treasury bond yield tends to trade around the growth rate in nominal GDP on a y/y basis. It has been trading consistently below nominal GDP growth since mid-2010. The current spread is among the widest since then, with nominal GDP growing 5.4% while the bond yield is around 3.00%. – Ed Yardeni, August 2nd

Several structural factors have been distorting a “more correct” equilibrium long-term risk-free interest rate — if one exists at all — which are now beginning to fade.

We counsel patience. The train has left the station. Interest rates are on the move.

Fundamentals

Before moving to the fading structural factors, which have held down long-term interest rates, let’s briefly take a look at the fundamental arguments for the collapse of term premia, the flat yield curve, and the low long rates.

1, Lower inflation for longer and forever. The recency bias of almost 30 years of disinflation is a hard habit to break. Cleary, this is an example of adaptive expectations, contradicting how I was trained as an economist in the school of rational expectations, which I never fully bought into, by the way. The disinflationary expectations ingrained in the market is the complete opposite of the problem of former Fed Chairman, Paul Volcker, inherited when he took over an economy in an inflationary spiral. Mr. Volker had to break the back of inflationary expectations with protracted and extremely tight monetary policy, which took short-term interest rates over 20 percent.

The Fed also learned that to be effective, it must have the confidence of the markets and the public. During the 1960s and early 1970s, various Fed chairmen made rumblings about fighting inflation, but they always backed down when the complaints about the resulting higher cost of credit grew loud. Fed Chairman William McChesney Martin, for example, was no match for President Lyndon Johnson, who depended on cheap credit to finance the Vietnam War and his Great Society. Because the markets observed the Fed’s lack of fortitude, they had no expectations that the Fed would conquer inflation. It is extremely costly to bring inflation down if inflation expectations don’t come down. Not until Volcker showed that the Fed could take the heat did the markets believe that the Fed was serious this time. – William Poole, St. Louis Fed

2. The New Economy. The new economy as we have described is more dependent on asset markets than almost anytime in the nation’s history. The fear of a bear market or big market hiccup sends the deflationistas into a tizzy. Even the term “deflation” seems to have morphed into a definition almost more closely associated with asset price declines than rising consumer prices. Economic progress appears now to be driven by this deflation/inflation dialectic. We concede this argument does deserve considerable merit.

.…the whole inflation/deflation debate has morphed into a dialectic, which is path dependent on asset prices. Stocks values move up to a critical level (which holders likely believe to be permanent) that stirs the animal spirits and kicks economic growth into gear. Inflation eventually becomes an issue moving interest rates higher. The asset bubble pops, stock values go down, confidence declines, aggregate demand softens and deflation now becomes the headline issue. Wash, rinse, repeat. – GMM

3, Negative and near-zero rates in Japan and Europe. A 10-year German bund yield of near 50 bps and a JGB yield of 13 bps are probably the strongest fundamental reason anchoring U.S. rates and holding back yields from spiking, in our opinion. Labeling the interest rates differentials as “fundamental” make us feel uncomfortable as we believe it is more of a technical issue. Nonetheless, even these rates are beginning to move higher. By this time next year, we fully expect that the European bond market bubble to have fully popped.

We reject the thesis global bond yields, including the U.S 10-year note, are driven by fundamentals. Measuring inflationary expectations based on interest rates, which are thoroughly distorted by the technicals of QE, is a fundamentally flawed proposition. The economic signals from the bond markets have been rendered null and void by the central banks.

That may be changing, however.

‘Nuff said. Let’s move on.

Structural Factors

We now examine four changing structural factors that have created a favorable technical environment for the U.S. bond markets, which have kept long-term interest rates abnormally low and pancaked the yield curve:

- The ballooning of the budget deficit during economic expansion;

- QE and its diminishing legacy of reinvesting maturing notes and bonds;

- Borrowing from the social security trust funds,

- Globalization

Budget Deficits

All of Washington, including even Tea Party fiscal conservatives, appear to have abandoned any semblance of fiscal discipline.

The U.S. budget deficit widened to $898 billion in the 11 months through August, exceeding the Congressional Budget Office’s forecast for the first full fiscal year under the Trump presidency.

The budget deficit rose by a third in the October to August period from $674 billion in the same timeframe a year earlier, the Treasury Department said in a statement on Thursday.

The U.S. fiscal gap has continued to balloon under President Donald Trump, raising concerns the country’s debt load, now at $21.5 trillion, is growing out of control. A combination of Republican tax cuts enacted this year — that will add up to about $1.5 trillion over a decade — and increased government spending are adding to budget strains. – Bloomberg, Sept 13th

The following table is an estimate of the Treasury’s financing needs over the next five years. We don’t put much faith in the precision of long-term economic projections. Politics can change, and policies will change. The economic situation could also go sideways causing a crisis.

They do, however, provide a framework, a basis for analysis, and usually get the direction and zip code correct.

What is clear, however, the Treasury will tap the markets for its trillion-dollar-plus funding needs for as far as the eye can see.

The deficit projections are taken from the CBO and OMB and have converted fiscal into calendar years. A small portion of the deficit financing will come from borrowing from government trust and pension funds, taking a smidgen of pressure off the markets.

We are confident in our estimates of the SOMA Treasury roll-off. The only uncertainty is the final size of the Fed’s post-GFC balance sheet and whether the Treasury maintains a consistent cash balance at the Fed. That is when the Fed will end quantitative tightening.

The combined annual financing needs of the Treasury over the next several years are large and will exceed the GDPs of even some of the largest emerging market economies.

When Fiscal Doves Cry

It surprised us that. the traditional fiscal conservative Republicans, at least in rhetoric, chose to implement a procyclical fiscal policy. Speaker Paul Ryan used to warn the U.S. was the next Greece if it didn’t get its fiscal house in order.

Paul Ryan, Jeff Sessions Warn Obama Budget Could Spur Greek-Style Debt Crisis

“Next year, the United States could be like Greece,” Sessions continued, referring to the severe debt crisis faced by that country as a result of uncontrolled government spending.

Ryan similarly warns on the House Budget Committee website: “The President’s budget ignores the drivers of our debt, bringing America perilously close to a European-style crisis.” – Huffington Post, February 2012

The procyclical tax cuts and spending ramp goosed an already real trending economy, causing growth to accelerate, but it was rare, nonetheless, for the U.S. or any developed economy.

If the larger deficits trigger an adverse market reaction, policymakers may be forced to implement procyclical policies during a downturn. Just as the markets are forcing the EM countries that have been hard hit this year to do — i.e., raising taxes and cutting spending during in an economic downturn.

Procyclical fiscal policy is puzzling: why would the fiscal authority want to amplify an already volatile business cycle by adding fuel to the fire during booms and aggravating recessions by cutting spending and increasing taxes? – FT

The net result of the higher deficits will be more crowding out in the global financial markets and pressure on long-term interest rates to move significantly higher.

The Diminishing Legacy Of QE

We constructed the following chart to illustrate the schedule of maturing Treasury securities by month, held in the Fed’s September 12th SOMA portfolio.

In the current month of September, for example, $19 billion of Treasury securities mature, but the total falls below the $24 billion monthly quantitative tightening cap (purple line) leaving zero SOMA cash available to reinvest and participate in the Treasury auctions. The $19 billion will not be reinvested and is reflected in the red bar. The Treasury will be forced to plug the gap with new market borrowings or rundown its cash balances at the Fed.

The same dynamics hold for the roll-off of the SOMA MBS portfolio, where the cash balances at the Fed of government-sponsored enterprises (GSEs) are reduced when mortgages run-off and not reinvested.

Asymmetric Effects Of QT

We need to think more about this but our first impression is the economic effects of quantitative easing, and quantitative tightening are not symmetric. Because of the difference on the liability side, QT appears that it will be more direct, more onerous than expected, and will be quicker in its economic impact than QE.

Moreover, QE enabled the government to issue the debt it now has to pay back to the Fed or forced to issue more marketable debt. QE hasblurred the lines between fiscal and monetary policy.

At the end of the day, quantitative easing (QE) has been just “turbo charged fiscal policy in drag with a lag.” Great hip-hop line, no?

September To Remember

September will be the first month in several years where the SOMA will not participate in any of the notes, bond, FRN, or TIPs auctions.

The same holds for October, when the QT cap steps up to $30 billion per month, as $24 billion of Treasuries mature.

In November, $59 billion of SOMA Treasuries mature, of which $30 billion (the QT cap) will not be rolled over (red bar) and drained from the financial system, with the remaining $29 billion (green bar) in cash used as noncompetitive bids in the variety of notes, bonds, FRN, and TIP auctions.

Reduction In SOMA Treasury Portfolio

The black line illustrates the decrease in the SOMA Treasury portfolio over time as securities roll-off.

Some argue that the stock of excess reserves are declining too fast, down 18 percent since QT began causing the Fed Funds rate to consistently trade at the top of the 25 bps target range. Consequently, the Fed will be forced to end its balance sheet reduction sooner than the markets think.

A plausible scenario. However, why not just stop paying or further reduce the interest rate on excess reserves (IOER), which will force reserves back into the Fed Funds market putting downward pressure on the rate?

If we had to guess, QT ends in June 2022 when the SOMA Treasury portfolio hits $1.5 trillion and the MBS portfolio around $1 trillion. We suspect, however, the glass will begin shattering long before then, forcing the Fed to reverse course.

History Of SOMA Participation In Treasury Auction

Our next chart illustrates the SOMA participation in every Treasury auction since September 2009, which was financed by the sum of its maturing securities during each particular month.

The green bars represent the SOMA percentage takedown of the total amount of securities issued during the auctions and the black line is the corresponding 10-year Treasury yield on the date of each auction.

Operation Twist

The Fed engaged in “Operation Twist” between September 2011 and December 2012 (two red bars) to bring down long-term rates. It sold shorter-term securities in its portfolio to purchase long-term Treasuries. It appears just anticipation of the program reduced yields as traders began front-running the Fed.

Interest rates began to spike as soon as the SOMA ran out of maturing securities and stopped participating in the auctions. That is what concerns us now.

The SOMA’s participation in auctions going forward will be sporadic, at best, which will likely put upward pressure on rates and further crowding out borrowers as the Treasury is forced to issue more marketable securities.

The following is the Treasury press release of the results from the August 30-year bond auction. Notice the SOMA took down almost 12 percent of the total outstanding bonds issued.

Declining SOMA Auction Participation

Our next chart shows the recent past and future SOMA participation in the Treasury auctions through 2019. The key takeaway here is that the SOMA will be active in the auctions in only five of the next 16 months,

We believe the bond market has not fully focused on the diminishing participation of the SOMA in the auctions going forward. It now has the data and should be on traders’ radar, causing upward pressure on long-term interest rates.

To Be Continued

We promised that we would get you the piece by the end of Friday.

As you’ve noticed, the post is very long and comprehensive. The final post is not yet finished but we will leave you with part one and the charts to the rest of piece.

We are traveling on Friday. Check in with us on Monday for the GUT final product.

Outline for Part II

Social Security Now In Deficit

No more free ride borrowing from the Social Security Trust Funds as the program is now running a structural deficit. Social Security has been running a primary deficit since the GFC.

Marketable debt is increasing in proportion to the total debt.

Globalization

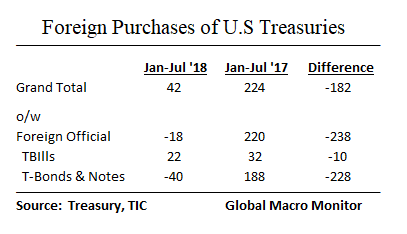

The U.S. has been highly dependent on foreign savings to finance its budget deficits.

Foreign purchase of Treasury securities declining

Trouble With The Curve

Outlook

On the question of bond issuance sucking up capital … I’m not sure that makes sense. Bond issuance is simply an offset to deficit spending. Should be 1 for 1 no? in other words, every bond placed by Treasury is offsetting a dollar spent in deficit. So … the factor at the margin becomes quantitative tightening, not the deficit. What am I missing?

K, Think of a global 100 dollars of savings to lend to borrowers. Assume stable lending for years. Now a big borrower comes in and wants 30 dollars. Others have to reduce there borrowing by $30… You are correct the money remains in the system

Will the US government default on entitlement promises, default on Treasury debt, or will it slash actual spending (not cuts in increases, actual reduction in spending)? Default via printing currency is very 3rd world, and its still default.

The problem is spending, and it cannot be solved with ever increasing amounts of debt that exceed the global supply. Analyzing SOMA borrowing is deck chairs on the Titanic. Unless spending gets under control, default is inevitable.

Greg, You are spot on. 42 percent of federal spending goes to Social Security and medicare. That will grow as baby boomers age. The Trust Fund is projected to bankrupt in 2032. That is it will now be redeeming its GAS Treasuries, which will have to be financed by new market issuance putting more pressure on the markets.

The pols will have to reform SS and Medicare. They can start by making its means tested. Why should George Soros get a social security check? Some will argue is was a pension and workers paid into it and deserve the retirement payments. That will be the challenge to politicians, convincing the public is was first,and foremost, a safety net for the poor seniors.

Thanks for the comment.

I am not arguing in favor of Soros (or any billionaire) getting social security, but it must be pointed out that he is getting a SS check because THAT IS WHAT CONGRESS PROMISED. The full faith and credit of the US Government either means something or it does not.

Its very deceptive to claim that defaulting against a wealthy creditor is somehow not a default. Social Security was not and is not a welfare scheme, nor was it ever advertised as such.

You are essentially saying the US government is going to default as soon as they can “convince the public” that some promises are pinky swears and some promises were made with fingers crossed.

Why are we discussing SOMA accounts when the debtor is planning to default, and just looking for the most politically expedient way to do so?

PS — Obama’s Treasury secretary bailed out Warren Buffet and Jamie Dimon, not bank tellers or mortgagees who borrowed more than they could afford to repay. Soros would be in the first category, other democrat voters are the second group.

macromon wrote: “… making its means tested. Why should George Soros get a social security check?”

Are we really supposed to believe that defaulting on one rich man’s social security promise is somehow going to make social security solvent? What if we canceled Soc Sec benefits for the 500 richest people in the country? Each of these wealthy people gets a couple thousand per month (everyone gets the same benefits, up to a certain limit which the wealthy hit long ago).

Defaulting on benefits to the 1000 richest US citizens would barely make a dent in Social Security’s deficit, not to mention this still amounts to a default even if it is a politically popular default. Social security would have to default on benefits to MILLIONS of people to be solvent — and medicare defaults will be even more severe.

Please do not write that means testing for a few rich people would somehow fix trillions in unfunded promises.

Actually, Soros was extreme example to make a point. The bar will be much lower. You can’t expect young generation to pay for promises made by pols. Reform or monetize.

Pingback: The Gathering Storm In The Treasury Market – Viralmount

Pingback: The Gathering Storm In The Treasury Market – The Deplorable Patriots

Pingback: The Gathering Storm In The Treasury Market – Olduvai.ca

Pingback: The Gathering Storm In The Treasury Market – students loan

Pingback: The Gathering Storm In The Treasury Market | peoples trust toronto

Pingback: The Gathering Storm In The Treasury Market | Zero Hedge

Pingback: The Gathering Storm In The Treasury Market | Site Title

Pingback: The Gathering Storm In The Treasury Market | GEOECONOMIST

Pingback: The Gathering Storm In The Treasury Market - Novus Vero

Pingback: The Gathering Storm In The Treasury Market | COLBY NEWS

Pingback: The Gathering Storm In The Treasury Market | StockTalk Journal

Pingback: The Gathering Storm In The Treasury Market - open mind news

Pingback: The Gathering Storm In The Treasury Market | SPLIT INSTITUTE

Pingback: The Gathering Storm In The Treasury Market – The Trading Letter

Pingback: The Gathering Storm In The Treasury Market – Forex news – Binary options

Pingback: The Gathering Storm In The Treasury Market - forexdemoaccountfree.com

Pingback: The Gathering Storm In The Treasury Market – top10brokersbinaryoptions.com

Pingback: The Gathering Storm In The Treasury Market – secretsforex.com

Pingback: The Gathering Storm In The Treasury Market - megaprojectfx-forex.com

Pingback: The Gathering Storm In The Treasury Market – Forex news forex trade

Pingback: The Gathering Storm In The Treasury Market - aroundworld24.com

Pingback: The Gathering Storm In The Treasury Market – forex-4you.com, الفوركس بالنسبة لك

Pingback: The Gathering Storm In The Treasury Market - noticiasp

Pingback: The Gathering Storm In The Treasury Market – The Conservative Insider

Pingback: The Gathering Storm In The Treasury Market - forex analytics Forex Factory provides information to professional forex traders; lightning-fast forex news; bottomless forex forum; famously-reliable forex calendar; aggregate ...

Pingback: La Tempête Sur Le Marché Du Trésor – forex-enligne-fr.com

Pingback: The Gathering Storm In The Treasury Market – forexreadymax.info

Pingback: The Gathering Storm In The Treasury Market – Binarybrokersblog.com – binary options trade forex

Pingback: The Gathering Storm In The Treasury Market - pustakaforex.com

Pingback: The Gathering Storm In The Treasury Market – fastforexprofit.com, الفوركس بالنسبة لك

Pingback: The Gathering Storm In The Treasury Market – 4-forex.info

Pingback: The Gathering Storm In The Treasury Market – stocksoptionsandforex.com

Pingback: The Gathering Storm In The Treasury Market | AlltopCash.com

Pingback: The Gathering Storm In The Treasury Market – myforexx.info

Pingback: The Gathering Storm In The Treasury Market | Newzsentinel

Pingback: The Gathering Storm In The Treasury Market – forex analytics forexpic.com

Pingback: The Gathering Storm In The Treasury Market – comparforex.com

Pingback: The Gathering Storm In The Treasury Market - entertainment-ask.com

Pingback: The Gathering Storm In The Treasury Market – customchakra.com

Pingback: The Gathering Storm In The Treasury Market – mudahnyaforex.com

Pingback: A GLOBAL LIQUIDITY SHOCK FROM $1T OF SOMA TREASURY ROLL-OFF IN FIRST 8 MONTHS OF 2018 ALONE – MATASII

Pingback: THE ROOT CAUSE OF THE CURRENT EMERGING MARKET DEBACLE – MATASII

Pingback: HISTORICALLY US TREASURY RATES SHOULD BE MUCH HIGHER – MATASII

“Next year, the United States could be like Greece,” Sessions continued, referring to the severe debt crisis faced by that country as a result of uncontrolled government spending.

This is just silly of course. The US borrows in a currency that is not only its own, but which is the world’s reserve. So no, comparisons with Greece are ignorant drivel.

If you take Sessions comment literally, the US is unlikely to be in Greece’s situation in one year.

But its just as silly, if not more so, to accept Bernanke’s equally dumb comment that “the US has this thing called a printing press”. The man seems to believe he thought of this idea first, somehow ignorant of dozens of banana republics that tried to print their way out of trouble. News flash: the banana republics thought of this idea decades before Bernanke. And it didn’t work out for them either.

History is filled with global economic and military powers that could (and often did) try to print their way out of trouble. Every one of them collapsed. This time will not be different.

Spending must be curtailed, period. Please don’t give us your useless 3rd world drivel about printing money. It doesn’t work.

Pingback: WE FORGET THAT SOCIAL SECURITY IS NOW IN “STRUCTURAL DEFICIT” – MATASII

Pingback: US TREASURY IS DEPENDENT ON FOREIGN BUYERS WHO ARE REDUCING BUYING AS ECONOMIES SLOWDOWN – MATASII