Interesting chart from Bloomberg on the growing record short position by specs in 10-year note futures. Surprisingly, there has been no meaningful squeeze in the 10-year during 2018, even with the massive equity volatility shock in early February.

In fact, note prices fell and yields rose during that period, signaling, what we thought was the beginning of a stock bear market in the U.S., but we got our markets wrong.

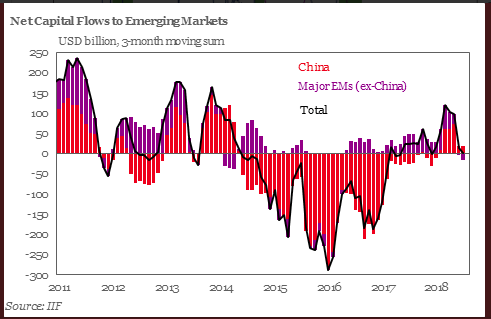

It was a shot across the bow and precursor to this year’s huge sell-off in the emerging markets.

Source: @lisaabramowicz1

A reversal in emerging market capital flows began in April.

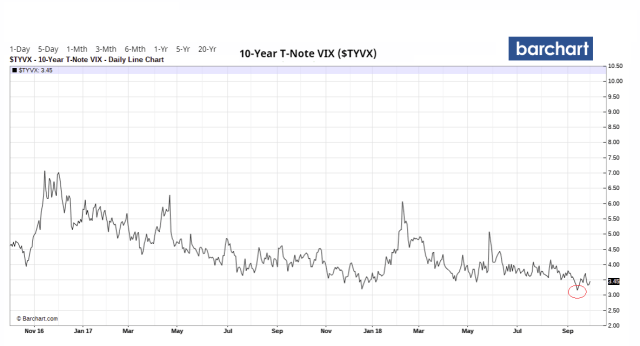

The 10-yield note yield has traded in a very narrow 35 bps range since mid-April, in spite of the large short position. There is bad and trench warfare, between the fading factors, which have kept rates low, and short bid keeping yields from breaking higher.

There has been some real selling in bonds, illustrated by the following chart of flows into and out of BlackRock’s $9.2 billion ultra-long U.S. Treasury ETF, which just had its largest one-day redemption since 2014.

Source: @lisaabramowicz1

The volatility index on the 10-year note hit a new low on September 13th, which indicates, at least to us, yields are coiled to make a big move.

We believe most of the structural factors that have been holding long-term interest rates artificially low, and suppressing term premia are fading, and the next move in yields will be higher and quicker, once the 3.11-3.13 percent resistance level gives way. That is just a chip shot away.

Nevertheless, the Treasury yield curve has been distorted by central banks’ QE programs, making bonds very difficult to read and trade for many years. Bond market vigilantes, R.I.P..

Even the gross issuance of Treasury securities this year appear to illustrate the bias by policymakers to keep the 10-year note dear.

We suspect it’s about to get interesting. Stay tuned.

Pingback: Alea Iacta Est! | peoples trust toronto

Pingback: Alea Iacta Est! | StockTalk Journal

Pingback: Alea Iacta Est! | ValuBit

Pingback: Alea Iacta Est! – TCNN: The Constitutional News Network

Pingback: Alea Iacta Est! - Novus Vero

Pingback: Alea Iacta Est! – Wall Street Karma