He caved. At least in rhetoric.

Interest rates are still low by historical standards, and they remain just below the broad range of estimates of the level that would be neutral for the economy‑‑that is, neither speeding up nor slowing down growth. My FOMC colleagues and I, as well as many private-sector economists, are forecasting continued solid growth, low unemployment, and inflation near 2 percent.

– Fed Chairman Jerome H. Powell, November 28th

Call us skeptics.

The current 2.25 percent Fed Funds rate with a “near 2 percent inflation,” the Chairman’s words, equates to a level “just below… the range of estimates that would be neutral for the economy”? To be exact, year-over-year CPI in October was 2.5 percent with core CPI coming in at 2.1 percent.

Yes, oil prices have collapsed. Inflation will temporarily come down. Yada, yada, yada.

The stock market was moving lower, President Trump was ranting and raving, and tweeting, the market clowns were proclaiming a coming economic deflationary apocalypse after two just 10 percent S&P corrections in 2018, all in the context of a negative real Fed Funds rate and ubiquitous labor shortages with a sub-4 percent unemployment rate. Seriously, folks?

Chairman Powell, simply, caved to political pteesures. Punto!

Janet Yellen may be short but that girl did have spine, did not day trade the S&P nor the economic data, was methodical in her approach, and truly understood the complicated dynamics of the economy.

Chairman Powell the first non-economist in 40 year since Wiiliam Miller, who was a disaster and ushered in the Carter administration’s inflation spike, may just have committed a fatal blunder if markets believe the Fed is losing its independence from political pressures. Too early to make a definitive judgment, however, and we are not ready to write off the Chairman just yet.

But negative real policy rates with unemployment less than 4 percent and a “strong economy” is close to a range estimates that are neutral? Not credible.

Negative Real Fed Funds Is Hardly Close To Neutral

The real effective Fed Funds rate (using monthly yoy CPI inflation) has been negative every month since October 2015, and 94.4 percent of the months since November 2009 (102 out 108 months).

Other than 2018, a negative real Fed Funds rate with a corresponding unemployment rate under 4 percent has only occurred once in the last seventy years (see chart).

Since 1956 there have been only 64 months where the civilian unemployment rate was below 4 percent. Only in 9 of those months, the real Fed Funds rate has been negative, 6 of which have occurred this year. Moreover, in 1957, the Fed Funds rate was not the primary monetary policy tool that it is today.

The real Fed Funds rate with a sub-4 percent unemployment rate during the 64 months has averaged 1.64 percent. That is no chip shot from last month’s reading of -0.34 percent.

Headline inflation will fall in November with the collapse of oil but come on, man!

If inflation falls to 1.5 percent (doubt it can be sustained) and rates move up another 75 bps, we are in business.

Labor Shortages Matter

We don’t think this “time is different.” Labor shortages still matter.

If you don’t believe us go talk to any young couple trying to buy their first house, who are forced out of the market due to high prices and limited supply.

“Labor shortages in the construction industry remain significant and widespread,” says Ken Simonson, chief economist of the contractor’s group. “The best way to encourage continued economic growth, make it easier to rebuild aging infrastructure and place more young adults into high-paying careers is to address construction workforce shortages,” he says. – The Post and Courier

Powell Caved To Political Pressure

The Chairman wilted under the relentless pounding by President Trump, in our opinion. How do you think foreign holders of U.S. Treasury bonds are feeling? Can they feel the love tonight?

Foreign bondholders are already fleeing the market.

Top foreign holders of Treasuries like China and Japan have shrunk their portfolios of U.S. government bonds this year, and a recent barometer of participation in Treasury auctions suggests overseas buyers have not been showing up in force, according to Treasury Department data.

Some auctions since late October had the weakest foreign participation rates in nearly a decade, a Reuters analysis of U.S. Treasury sales shows. At the same time, auction sizes are rising fast, with bond issuance this quarter projected to set a record of $83 billion after deducting maturing debt.

“We do worry about where demand for Treasuries is going to come from, given the ongoing significant increase in supply,” said Torsten Slok, chief international economist at Deutsche Bank. – Reuters

Increasing Size Of Bond Auctions Is The Real Culprit

In our reading of the Chairman’s speech today, no peep of the Fed’s balance sheet runoff (we missed the Q&A), which, coupled with the Treasury’s increased borrowing requirement due to higher deficits, is what is really impacting and spooking the market, in our opinion. Even though today Mr. Market acted as if it is all about the trajectory of interest rates.

Going from zero to 2 percent with a “near 2 percent” inflation isn’t going to shut down a viable economy, much less “the greatest economy ever,” or even make a dent in it. The question becomes then, do we have a viable economy or is it a “new economy.” excessively dependent on asset values?

Our hypothesis that the economy is becoming more influenced by asset prices and debt, and to a lesser extent by income (which is endogenous) due to a secular stagnation in real wages, is a work in progress.

Moreover, the whole inflation/deflation debate has morphed into a dialectic, which is path dependent on asset prices. Stocks values move up to a critical level (which holders likely believe to be permanent) that stirs the animal spirits and kicks economic growth into gear. Inflation eventually becomes an issue moving interest rates higher. The asset bubble pops, stock values go down, confidence declines, aggregate demand softens and deflation now becomes the headline issue. Wash, rinse, repeat. – GMM, March ’18

Nevertheless, take a look at the dramatic growth in the size of this year’s monthly Treasury auctions. The total gross issuance of coupon notes/bond, the 2-year FRN, and TIPs, increased 35 percent from last November, growing from $187 to $252 billion.

Those funds have to come from somewhere, folks, and it ain’t from the central banks anymore. We’re not so certain the global markets can adapt, or, at the very least, are going to have difficulty living in this brave new world.

SOMA

The FED’s SOMA portfolio took down 11.59 percent of the November auctions with the refinancing of its maturing Treasury portfolio in excess of the $30 billion quantitative tightening cap. Through 2019, however, the Fed will be participating in only 4 of the 13 monthly auctions even as the Treasury’s financing needs continue to grow.

It will be interesting to see how the bond market holds up under the growing technical stress during the next year. We are taking the over on interest rate forecasts, by the way.

In addition, remember, it was the bond yield breakout through 3 percent that precipitated the Q4 stock market volatility. Watch this space.

Treasury Yield Curve Management

We also found this chart interesting. The Treasury has dramatically increased its relative issuance of 2-years, up 54 percent this month from last November, and held back on 10-year issuance. We are not familiar with the government’s yield curve management policy and thus not really at liberty to comment too much.

The data do explain a lot technically, at least to us, as to why the yield curve has pancaked this year. Is it an explicit policy?

Makes sense to us. Keep long rates down. Kind of like an Operation Twist run out of Fifteenth and Pennsylvania.

Upshot

The market rebound has been less feeble than we expected. We got nervous a few nights ago as everyone seemed bearish and we were all leaning on the wrong side of the ship. Then along comes Jay.

G20

This weekend G20 and the Trump-Xi dinner should be interesting. The rebound in stocks will most likely embolden Trump to play harder, and last week’s election in Taiwan strengthens Xi in geopolitical political terms, though China has been accused of meddling in that election.

The U.S.-China relationship is much larger than trade and Taiwan is at the top of the list.

A pair of Navy ships sailed through the Taiwan Strait on Wednesday, just days before President Donald Trump is expected to meet Chinese President Xi Jinping during the Group of 20 summit in Argentina.

The guided-missile destroyer USS Stockdale and the replenishment oiler USNS Pecos made a “routine” transit that “demonstrates the U.S. commitment to a free and open Indo-Pacific,” Pacific Fleet spokesman Lt. Cmdr. Tim Gorman said in a statement. – Stars and Stripes

There could be positive news from the G20 that Mr. Market may like, such as a delay in another round of tariff increases — totally absurd, in our book — or things could fall apart. We certainly don’t expect a major breakthrough.

S&P500

That brings us back to the S&P500.

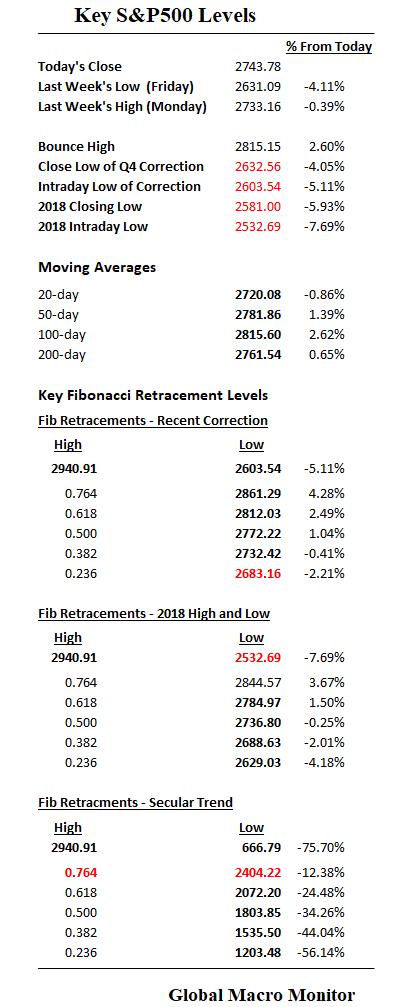

Recognizing momentum begets momentum, today’s take out of last week’s high is unduly positive. We need a few days of closing above the 200-day and a break above the 50-day, 1.4 percent higher, for us to believe this market continues to rally through December. Otherwise, given our above analysis, which we believe the market may soon begin to internalize, consider the past few days an early Christmas present to lighten up and/or get shorty.

To paraphrase the Chairman today, who was paraphrasing Thomas Jefferson, “eternal vigilance is the price of financial stability [survivability].”

Hello there, just became alert to your blog through Google, and

located that it is really informative. I’m going to watch out for brussels.

I’ll appreciate for those who proceed this in future. Numerous folks will likely be benefited out of your writing.

Cheers! https://zederex.org/

Pingback: The S&P Levels You Need To Know | ValuBit